FAQ's

When do transactions post to my account?

Your transactions post immediately except for a short period each evening when our system is completing nightly processing. During this time any transactions created in Internet Home Banking are temporarily stored and posted when the system’s night processing is complete.

I’ve changed my email address; do I need to let the Credit Union know?

Yes, this is very important. You may change your email address under the “My Profile” section of Internet Banking.

How do I see current activity on my account?

From the Account Summary Page, simply click on the “Account Name” link associated to the account you would like to view. There are a number of options of ways you can view your account activity.

Why does my Line of Credit show a debit for interest charges?

A single credit will appear showing the total payment, then a separate transaction will show the amount of interest that was paid to the loan from that transaction.

Why does my checking account show a negative balance?

This means that you have overdrawn your account, and overdraft protection has covered the overdraft. Instead of overdraft transfers being made each time you overdraw your account, a single transfer covering all overdraft transactions (provided funds are available) will occur that night.

Is download available to Quicken or CSV?

Yes, web connect to Quicken is currently available as well as CSV downloads using the “Export” option on the account history page. Downloads will include whatever date range you are currently viewing.

Why can’t I change all of the Recurring Transfers that show on my account?

You are only able to change Recurring Transfers that you set up online. Any scheduled transfers set up by the credit union must be changed by calling the credit union at 800-836-8010.

How can I view cleared checks?

Select the account the check was written from by either selecting the “Account Name” from the “Account Summary” screen. Click on the link in the Check # field of the check you would like to view. If you are experiencing problems retrieving check images from your account please contact us.

I can’t locate transfer to person. How do I do that?

If your account has been enabled to transfer to another member, that member’s account number will be displayed in the “To Account” dropdown list. The system will list the entry with your Member ID followed by a colon and then the other member’s account number. Simply enter a dollar amount, select your “From Account” and then select their account from the “To Account” list and then click “Transfer Funds”. Confirm the information is correct on the confirmation screen and the click Transfer Funds again to complete the transaction.

If the account you wish to transfer to is not listed in the “To Account” dropdown list, please contact us and provide us with the account numbers that you wish to be able to transfer to. We will add these accounts to your Internet Banking account

When is Internet Banking available?

Internet Banking is available 24 hours a day, 7 days a week. Rarely, Internet Banking and Bill-Pay are unavailable due to system maintenance. In most instances, we are able to provide ample notice when the system will be unavailable.

Is there a fee to use Internet Banking?

Internet Banking Internet account access is free to members. Bill-Pay is also free.

Can anyone else access my account information?

No. Your online account information is available only through access methods that have been rigorously tested for their secure access. The information is not public. Unless you share your User Name and Password, no one else can access your account information online. Notify Member Services immediately if you notice any unusual account activity by calling 800-836-8010.

Why won’t the login page retain my login information?

This was done as a security enhancement. It is a security risk to have your login information retained on the login page.

What transactions are available via Internet Banking?

With Internet Banking, you are able to perform virtually any transaction you would be able to perform in a branch office or over the phone.

What are “cookies” and do I need them to be “enabled”?

Yes, you must have session cookies enabled to access Internet Banking. Please refer to your browser’s respective documentation for help in enabling cookies. The type of cookie used by the credit union is not harmful and is temporary. The cookie is deleted when you exit Internet Banking.

What if I have questions or problems?

If your questions are account related, please call 800-836-8010. If you believe the trouble you are experiencing is due to a connection problem, please contact your Internet Service Provider.

Do I need Internet Banking to use Bill-Pay?

Yes, you must log in to Internet Banking and have a checking account with the credit union in order to use Bill-Pay. To sign up, click the Free Bill-Pay link in Internet Banking and follow the instructions.

How do I sign up for Bill-Pay?

You can sign up through Internet Banking by clicking on the “Free Bill-Pay” link from within Internet Banking and following the instructions.

Is there a charge for online Bill-Pay?

Bill-Pay is free.

When should I set up a Biller without using an account number? Is this a privacy feature?

This option is not a privacy feature and should only be used when you need to pay a company which has not issued you an account number. If you have an account number with the company you should always choose the first option (Company with an account number). This will ensure your payment is posted properly and in a timely manner with the company. Any Billers set up without an account number require the payment to be sent as a check. Also, the company receiving the payment will have to research to which account the payment should be applied. This could cause a major delay in the payment being applied to your account.

How do I find a Biller’s address?

To view the address of a Biller, click on the “Manage My Bills” tab, select the Biller you wish to view, then click on the “Update Biller Information” radio button.

I am unable to access Bill-Pay using Internet Explorer XP. What is the problem?

Make sure the Content Advisor is disabled. To check this, open Internet Explorer and click on Tools (from the top bar), Internet options (from the drop down list) then Content tab. Make sure the Content Advisor section is not enabled.

Why are some of the Bill-Pay functions not working correctly?

JavaScript is required for optimal functionality. If JavaScript is disabled, certain features or functions will not work properly. Note: Due to the JavaScript requirement Microsoft Internet Explorer version 5.1.7 can not be used.

How can I get help?

There are two ways to get help: Click on the help button at the top right hand corner of the main Bill-Pay screen and identify your question on the FAQ. For general Bill-Pay questions, call our toll free Bill-Pay support number at 866-393-0527.

Can I set up Bill-Pay from more than one checking account?

Yes, at the time of enrollment you may select up to 5 checking accounts by holding ctrl and clicking on the accounts you would like to add from the dropdown list of checking accounts you own.

If you wish to add additional checking accounts to your bill-pay account after you have already enrolled in bill-pay you may do so as well. Simply log click “Free Bill-Pay” and then select “My Accounts”

- In the “What would you like to do?” section, click Add an account. The account information appears below the add option.

- In Account Type, select the type of account from which the funds are withdrawn. The account type can be a regular checking account or a money market account with check-writing privileges.

- Click either Personal Account or Business Account, depending on the type of account you want to add.

- In Account Name, type something that identifies the account to you. Typing a description for the account name helps remind you which account you are using for example, My Checking or My Business Expenses.

- In Routing Transit Number, select your financial institution’s routing transit number from the list. Tip: You can usually find this number in the bottom left corner of your check, or you can call your financial institution and ask for the number. This number must be correct for your payments to process.

- In Account Number, type your account number. Tip: You can usually find this number at the bottom of a check or on your account statement. This number must be correct for your payments to process.

- In Confirm Account Number, retype your account number to verify it.

- Click Add Account. A message confirms that your new account has been successfully added.

- Click Finished. The new account appears in your accounts list.

Can I make my mortgage payment online via Internet Banking?

Yes. You may make a regular mortgage payment for the exact amount due. If your loan is past due, however, the system requires the amount due to bring the loan current, including any late fees.

Can I make an online payment with extra principal?

Yes. You may make a regular payment with extra principal included as long as it is included in the same transaction. (Example: regular payment = $950.00, extra principal = $50.00, transaction amount = $1,000)

Can I make a principal-only payment?

No. The system will not accept a principal-only payment. If you wish to make a principal-only payment you may mail a check or call us to transfer the funds.

Can I make an extra payment to my escrow account online?

No. If you wish to make an extra payment to your escrow account you may mail a check or call us to transfer the funds.

Can I pay off my mortgage online?

No. Mortgage pay off transactions cannot be posted online. Please call us if you wish to pay off your mortgage.

When is my due date?

All Visa payments are due on the first day of each month.

If my payment is a few days late, will I be assessed a fee?

No. Pittsford FCU does not assess late fees for Visa Platinum accounts.

Why do I see an interest charge in my LOC history?

History provides details on each transaction and a running balance. The running balance in history is a “transactional balance”, not a principal balance. This means that the transactional balance information you see in history contains all elements of a loan, including principal, interest, and late fees. Interest is charged to the loan at the end of the month and added to the running balance. When the member makes a payment, the interest (and principal if enough funds are paid) is subtracted from the running balance.

Does the credit union compound interest now?

No, we do not compound interest. The system uses the principal balance of the loan to calculate the daily accrued interest.

I satisfied my monthly payment for October, so why does my due date still say 10/31/06?

Due dates are not advanced until the next billing cycle. Once the new bill is created, the due date will advance. If a payment is past due, the due date will remain the same until payments are current.

I paid my Line of Credit to $0.00 via Internet Banking, but now there’s an interest charge showing for $0.29. Why?

Most likely the amount applied to the loan was the balance displayed as shown on the account summary page. In order to fully pay off a loan, members need to use the “Transfer Funds” account transfer feature to first determine the payoff amount and then transfer that total to satisfy both the principal and interest amounts due.

To determine the payoff amount select the “Transfer Funds” button, then the “Please choose a TO account” drop down button. The system will then display all of your “transfer to” options. For all loans listed, you will first see the account number, then a description of the account followed by the principle balance, the payoff amount, the interest owed and the next payment due date.

How do I make a payment in Bill-Pay?

To make a payment, simply:

- Locate the payee you wish to pay and enter the dollar amount you want to pay.

- Enter the payment delivery date or click the calendar icon to display a calendar with available delivery dates in blue.

- Click on the “Pay” button to make the payment. A confirmation message will appear in the bottom half of the payee tile for your reference.

What is an eBill?

An eBill is an electronic version of your paper bill that you receive directly within Pittsford FCU Bill-Pay. An eBill allows you to conveniently view and pay a bill in one place, right from Bill-Pay.

How do I know when my eBills are delivered?

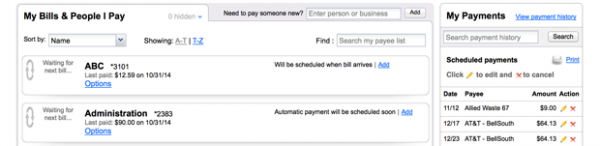

Once you set up an eBill, you will automatically receive an email notification when your eBill arrives. There are also notifications on the “My Bills & People I Pay” page of the new Bill-Pay to alert you of any eBills that need your attention. (See example below.)

How do I make sure a payment has been made?

To view payments that have been made in the new user interface review the list of “Scheduled payments”, “In-process payments”, or “Recently processed payments” on the right hand side of the “My Bills & People I Pay” page. You can click on the “View payment history” link to view additional detail.

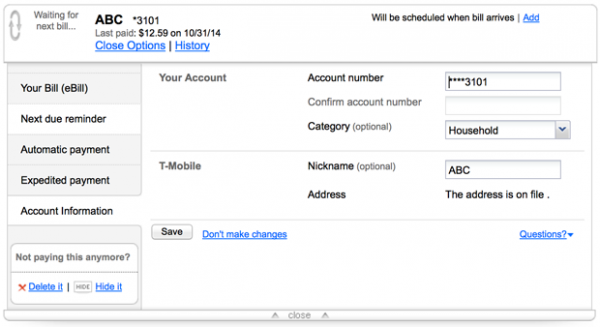

How do I change a nickname?

To change a payee nickname click on the “Options” link below the payee name. Then click on the “Account Information” tab. Next, enter a new nickname, and save your changes. (See a screenshot below).

Still have questions?

Please do not hesitate to send us an email or contact us at 585-624-7474.